Germany continues to hold its position as the most robust direct selling market in Europe, with steady growth, legal clarity and a consumer base that remains highly receptive to the channel. For international companies seeking to expand within the EU, Germany offers a compelling mix of market scale, strategic location and infrastructure.

A Steady Growth Trajectory

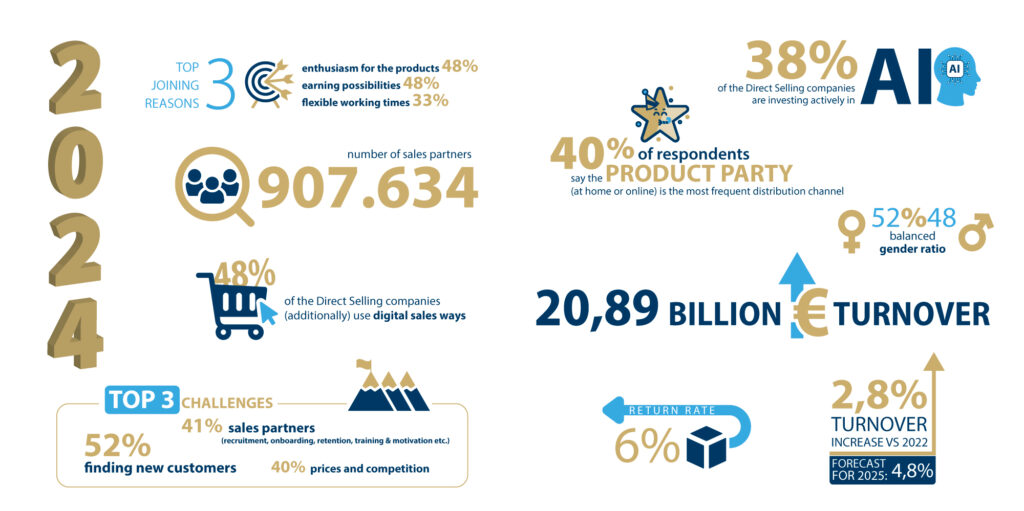

In 2024, the German direct selling market grew by 2.8 percent, reaching a total turnover of €20.89 billion, according to the 2025 Market Study released by the German Direct Selling Association (Bundesverband Direktvertrieb Deutschland—BDD) and conducted in partnership with Professor Dr. Florian Kraus from the University of Mannheim. The study points to a forecasted growth rate of 4.8 percent in 2025, continuing a trend of stable expansion over the past decade—even amid global economic uncertainty.

Germany’s population of 83 million, central European location and proximity to key neighboring markets like France, Switzerland and the Netherlands make it a strategic launchpad for pan-European growth.

Hybrid Sales Models Define the Market

German direct selling companies have embraced a hybrid sales approach that blends digital innovation with personal consultation. This combination has proven effective in balancing operational efficiency with the trusted relationships that consumers still seek.

- Thirty-eight percent of German companies are currently investing in artificial intelligence (AI) tools, including automated support systems, predictive sales analytics and multilingual communication platforms.

- Despite this digital evolution, personalized product advice remains a cornerstone of the sales process, reinforcing consumer confidence and loyalty.

This model contributes to Germany’s low product return rate of just six percent, significantly below typical ecommerce figures. According to BDD General Manager Jochen Clausnitzer, the ability for consumers to engage with products and take time with their decisions results in more intentional purchases and higher satisfaction.

Structural and Legal Considerations

For companies entering the German or EU market, the legal and organizational framework can pose a challenge—but also offers predictability and transparency.

Companies must evaluate whether to work with independent commercial agents or resellers. Each model comes with implications for taxation, branding control and data access. German employment law also places clear distinctions between contractor and employee status, and proper classification is essential to avoid regulatory issues.

EU competition law further influences operations. For example, direct selling companies cannot require mandatory starter kits from agents, a detail that often surprises new market entrants.

Working with commercial agents is a commonly preferred route, as it allows companies to retain brand consistency, pricing control and customer data access even if a sales partner exits the organization. It also supports the use of replicated websites and prohibits unauthorized online sales through third-party marketplaces.

Role of the BDD in Market Support

Founded in 1967, the German Direct Selling Association (BDD) represents over 40 member companies and serves as the primary industry association for direct selling in Germany. The BDD plays a key role in facilitating market entry for international firms by offering:

- Legal consultation and compliance support

- Review of contracts, compensation plans and marketing materials

- A biannual working group structure, with expert forums on topics such as digitalization, partner engagement and future market trends

- Access to the annual German Direct Selling Congress, a gathering of sector stakeholders and policymakers

- Established networks with external experts in law, tax, communications and technology

The BDD also leads industry-wide public relations efforts and advocates for fair business practices and consumer protection within the EU regulatory context.

Evolving Consumer Preferences

While digital channels continue to influence consumer behavior in Germany, several core expectations remain unchanged:

- Personalized product advice remains central to the buyer experience, even in digital-led interactions.

- Hybrid shopping journeys—such as learning about products online and purchasing in-person or vice versa—are becoming the norm.

- Transparency and sustainability significantly influence buying decisions. Consumers expect brands to clearly communicate product origins and adhere to ESG (Environmental, Social and Governance) standards.

- Top-performing product categories include household goods, cosmetics, nutritional supplements and beverages.

- Community-driven shopping experiences, such as live-streamed product demos and small-scale influencer marketing, are gaining traction.

A Post-Brexit Opportunity

As companies reevaluate their European operational bases in the wake of Brexit, Germany offers legal certainty, market scale and EU-wide reach. Its regulatory framework supports compliant, long-term business operations while allowing companies to tailor strategies to local expectations.

Willkommen in Deutschland

Germany remains Europe’s most attractive direct selling market due to its size, stability and readiness for innovation. With supportive infrastructure, clearly defined legal pathways and a consumer base receptive to hybrid sales models, it offers fertile ground for international expansion.

For companies seeking a European foothold, Germany may not just be the first stop—it may also be the most strategic.

A Guide to Market Entry

“How to Succeed in Direct Selling and Social Selling – A Guide for Starting a Business in Germany”

Published by the BDD, this English-language guide offers practical insights for international direct selling companies entering the German market.

Topics include:

- Legal entity structuring: Subsidiary vs. branch

- Working with commercial agents vs. resellers

- Tax and employment law considerations

- Regulatory frameworks for digital selling and data privacy

Available via Amazon or directly from the BDD: info@direktvertrieb.de

An Online Exclusive from Direct Selling News magazine.

The post Why Direct Selling Companies Should Consider Entering the German Market first appeared on Direct Selling News.